Commercial Feed in Tariff Rates Australia

With certain solar incentive programs and installation discounts expiring in recent years, many Australians have begun to question whether solar remains a worthwhile investment. Solar remains a terrific method for Australian homes to save money on power, but only if you know how to locate a fair bargain.

The majority of power providers offer commercial feed-in tariff rates as basic products today. Some even provide goods created exclusively for solar panel owners. Solar plans differ slightly from conventional power plans. In addition to being charged for electricity consumption and supply, you will receive a feed-in tariff.

What is a feed-in solar tariff?

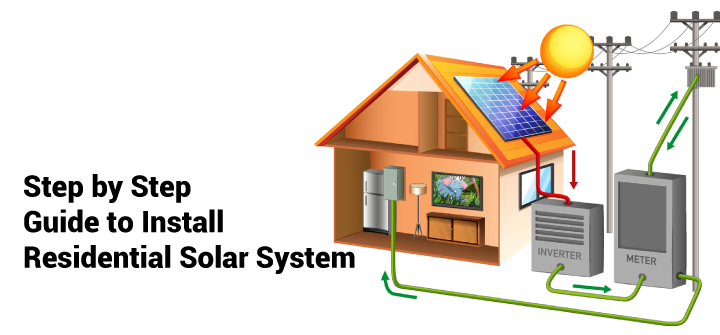

A feed-in tariff (FiT) is a modest credit refund that consumers receive for surplus power generated by solar panels or other small-scale generators. Simply said, unless you have a solar battery, you must immediately consume any solar energy generated by your solar panels or it will be sent into the common electrical system for use by other properties.

The property will get a feed-in tariff of a few cents for each kilowatt-hour (kWh) of solar energy exported to the electrical grid, typically between 7 and 16 cents per kWh. Instead of being paid out in cash, feed-in tariffs are deducted from your normal payment. A high feed-in tariff can significantly lower your power costs; thus, it is essential to compare solar rates.

A Solar Feed-in Tariff Varies from a Solar Rebate

As previously established, solar feed-in tariffs are a payment for electricity put into the grid after the installation of solar panels, while the solar rebate reduces the initial cost of purchasing a solar power system. The solar rebate (which is not a refund but a point-of-sale discount) gives a reduction of several thousand dollars for the majority of installations.

Australia's solar rebate will terminate on December 31, 2030, after being gradually phased away over the next years. While technically it is not a rebate, that is what it is popularly referred to as, which is why we often refer to it as such.

Single Rate and Variable Rate Tariffs (VIC)

These are the two primary tariff kinds offered by energy companies. As their names imply, single rate tariffs provide a fixed price for the power delivered back to the grid, whilst time-varying tariffs offer varied prices during peak and off-peak hours.

Is a Feed-in Tariff's Income Taxable?

There does not appear to be any specific tax legislation pertaining to income from commercial feed in tariff rates at this time. Whether the income is taxable depends on the nature of the activity that generated it. If it can be shown that the system was installed with the intention of earning a profit, then receipts under the feed-in tariff would be considered taxable income and all expenses associated with the income-generating activity would be deductible (eg depreciation).

In most instances, devices installed at residential locations would not be taxed since they would be deemed personal use/ hobby equipment (i.e. not in the nature of a business or profit making scheme). If the system is put on a business property, it will very certainly be taxed.